As there are no changes in the format the 2017 version can be used for 2018. All Extras are Included.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

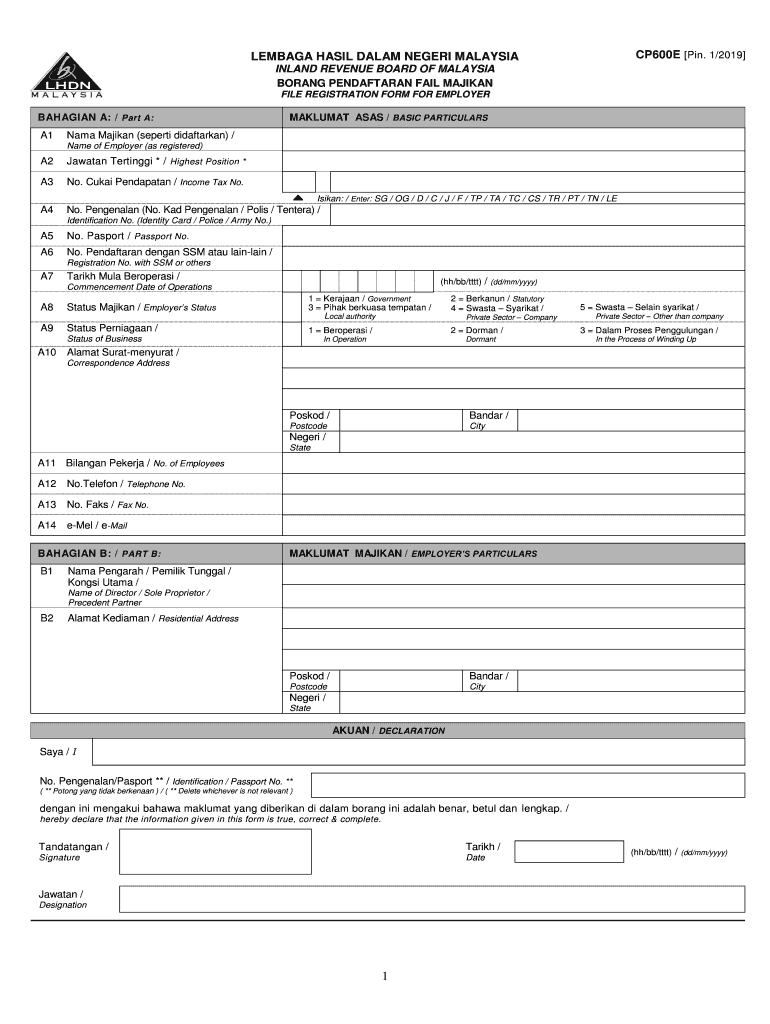

Identification Passport No.

. Import Your Tax Forms And File For Your Max Refund Today. A refer to the Explanatory Notes before filling up this form. Time To Finish Up Your Taxes.

Borang e due date 2018 Reduction of Tax Attributes Due to Discharge of Indebtedness and Section 1082 Basis Adjustment Keywords. Internal Revenue Service Center Attn. Ad File For Free With TurboTax Free Edition.

Premium Federal Tax Software. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Enter the full name of the employee as per his or her identity cardpassport.

Borang Ea 2018 Excel Borang E 2019 English Version - Effects on borang ea cp 8a 1 move the value to gaji kasar gaji upah atau gaji. As an example for CPD activities in 2018 the deadline for submitting CPD claim for 2018 to the myCPD system is 31st January 2019. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014. Total Time Allowed Generally we cant extend the due date of your return for more than 6 months October 17 2022 for most calendar year taxpayers. The use of e FORM TP 2018 2018 P2C - Pin.

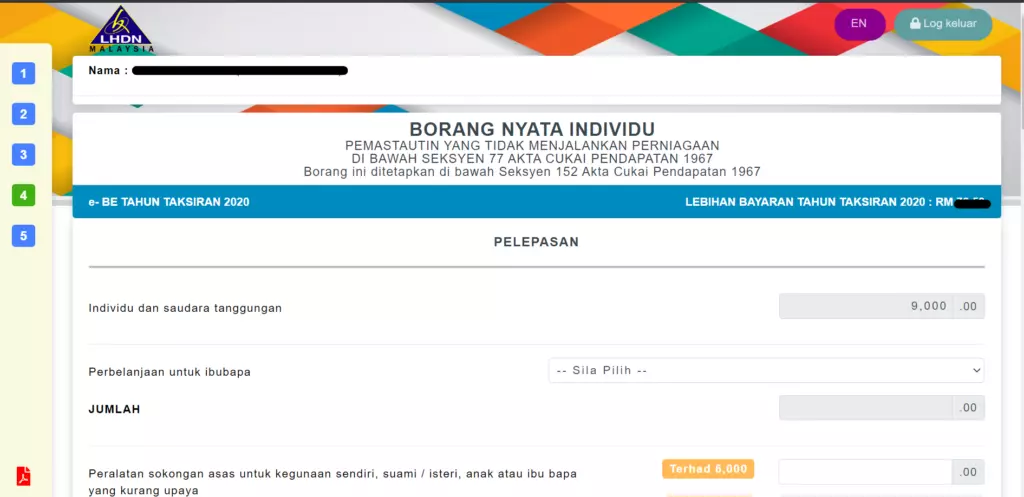

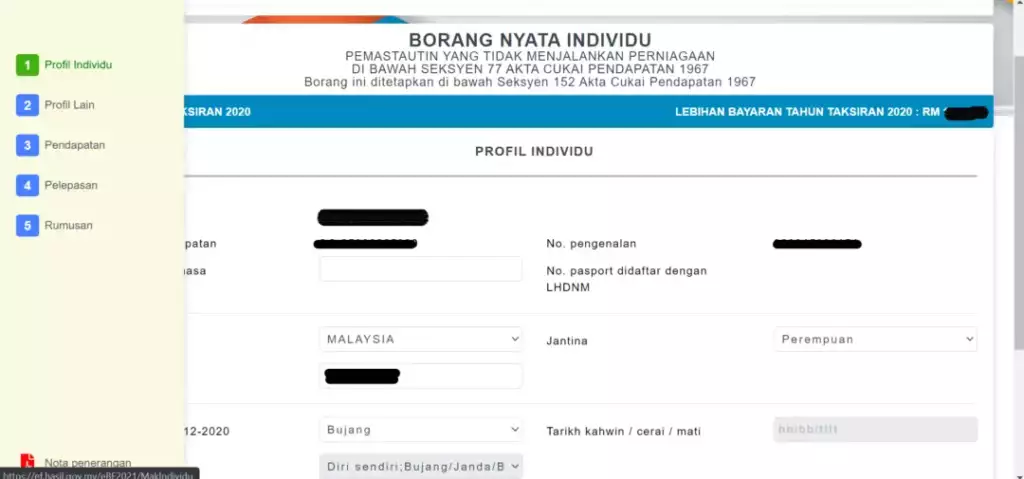

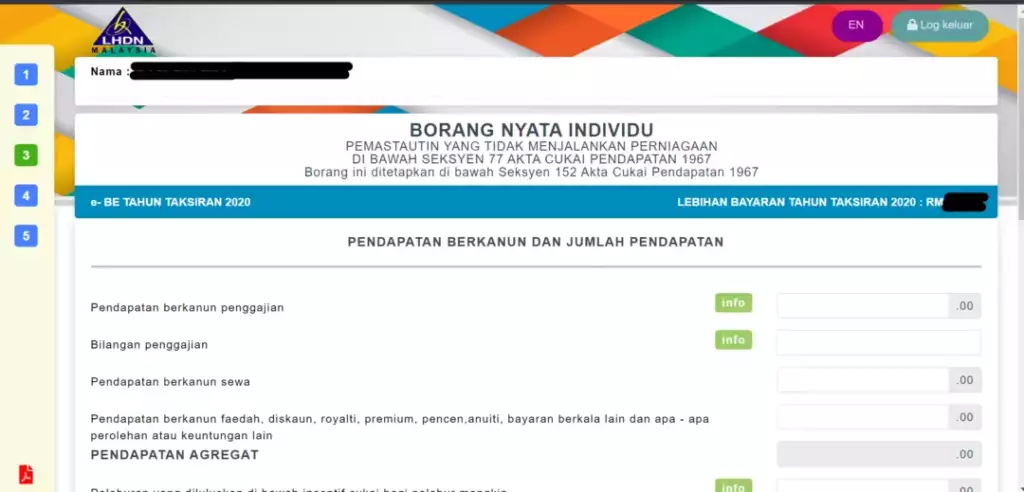

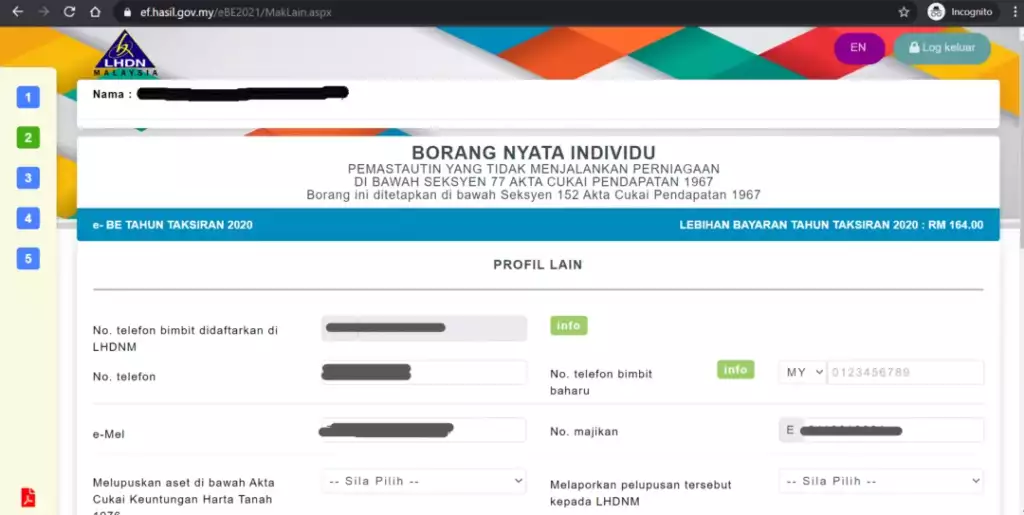

2018 RETURN FORM OF A INDIVIDUAL RESIDENT WHO DOES NOT CARRY ON BUSINESS UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 ame. This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved. Easy Fast Secure.

See If You Qualify and File Today. Failure to submit the Form E on or before 31 March 2019 is a criminal offense and can be prosecuted in court. Due date to furnish Form E for the Year of Remuneration 2018 is 31 March 2019.

Form E for the Year aof Remuneration 2017 i Submission of a Complete and Acceptable Form E Form E shall only be considered complete if CP8D is furnished on or before the due date for. BE 2018 YEAR OF ASSESSMENT FormLEMBAGA HASIL DALAM NEGERI MALAYSIA CP4B Pin. B Failure to furnish Form E on or before 31 March 2019 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967.

BR1M to continue focus on strengthening the economy. According to the Income Tax Act 1967 Akta 53. Sim kad digi live deadline for borang e submission 2018 contoh borang maklumat diri murid sekolah rendah.

RETURN OF REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION. With Talenox Payroll you can submit Borang E in just 3 steps. 2018 and fiscal year ending on.

Ad Prepare and file 2018 prior year taxes for Oregon state 1799 and federal Free. Identification passport no. Delete whichever is not.

The following information are required to fill up the Borang E. Key in the employees income tax number in this item. EMPLOYERS RETURN FORM Borang E Submit Employers Return Forms Borang E example E-2018 by 31st March every year even you dont have any employees starting from the following year of LLP registration.

Registering as a first-time taxpayer on e-Daftar. Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. 2018 Date Received 1 2 FOR OFFICE USE LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF A DECEASED PERSONS ESTATE UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 Name of deceased persons.

Dont be part of this statistic for the new year. RETURN ON REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF INCOME TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION FROM REMUNERATION 1994 FOR THE YEAR ENDED 31 DECEMBER 2018 Employers NoE RM K L S J M N P R Q Total claim for deduction by employee via odation. Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co.

Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia.

How To File Your Income Tax In Malaysia 2022 Ver

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

What Is Borang E Every Companies Need To Submit Borang E Otosection

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金

How To File Your Income Tax In Malaysia 2022 Ver

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Here S A How To Guide File Your Income Tax Online Lhdn In Otosection

What Is Borang E Every Companies Need To Submit Borang E Otosection

What Is Borang E Every Companies Need To Submit Borang E Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

My First Time With Income Tax E Filing For Lhdn Namran Hussin

How To File Your Income Tax In Malaysia 2022 Ver

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

How To File Your Income Tax In Malaysia 2022 Ver

What Is Borang E Every Companies Need To Submit Borang E Otosection

Form E 2018 What You Need To Know Kk Ho Co